The first time buying a home can be overwhelming and challenging. There are so many requirements, steps, and tasks. Mistakes can be expensive and time-consuming.

First-time homebuyers can actually enjoy the process. After all, it’s everyone’s dream to have their own home.

To simplify the process of buying a home, this article is a rundown of what you need to consider before buying a home and what you can expect from buying a home itself. Plus, some tips to make life easier after choosing your first home.

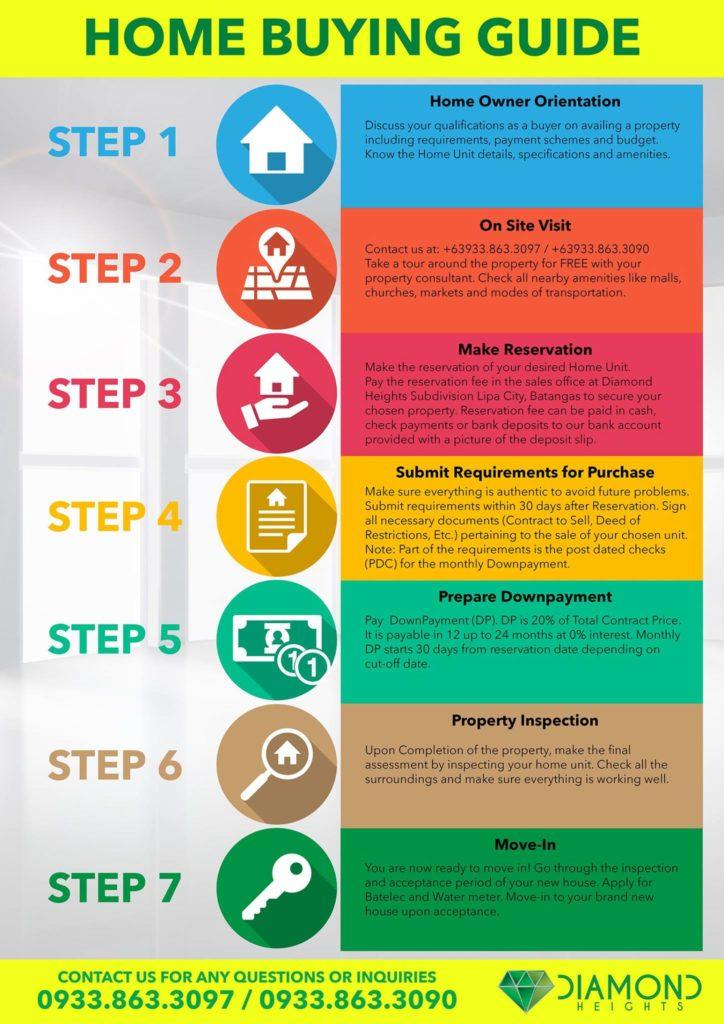

1. Home Owner’s Orientation

Discuss your qualification as a buyer on availing a property including requirements, payment schemes, and budget. Know the Home Unit Details, specifications, and amenities.

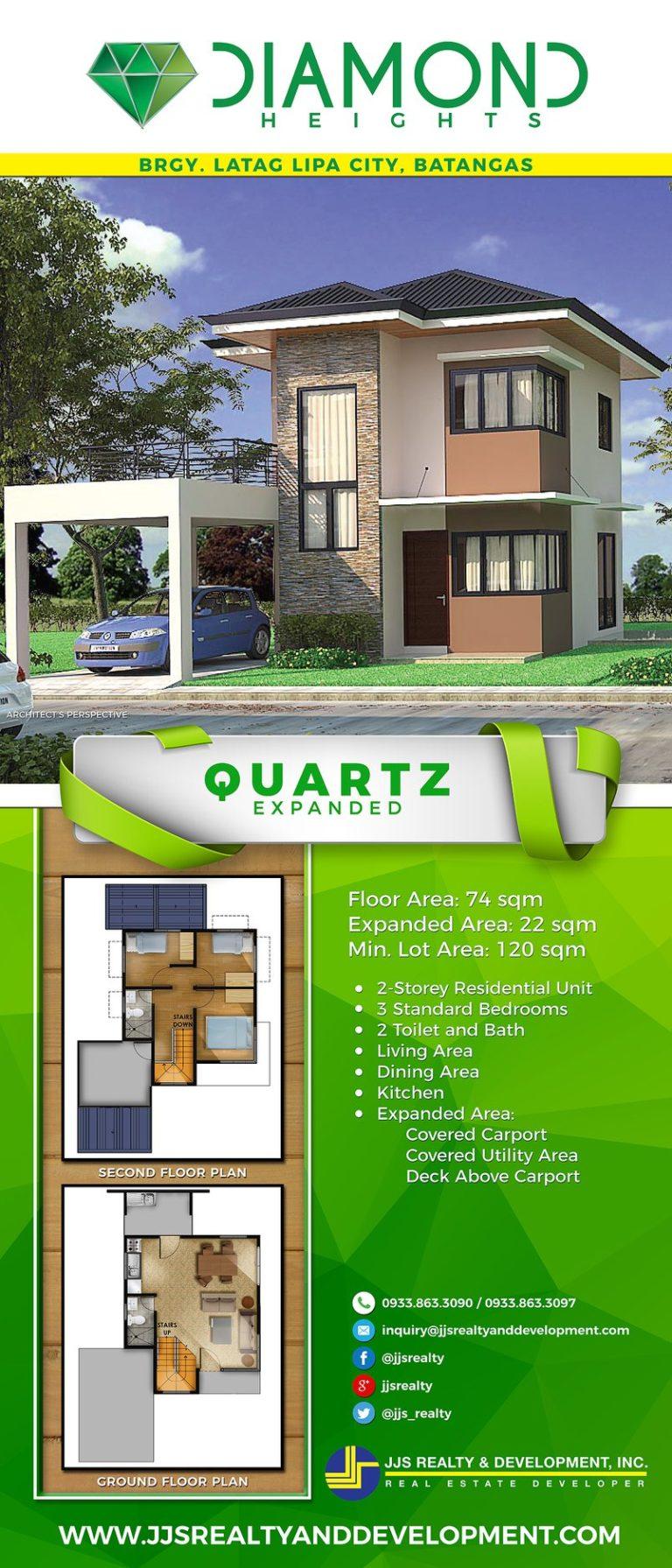

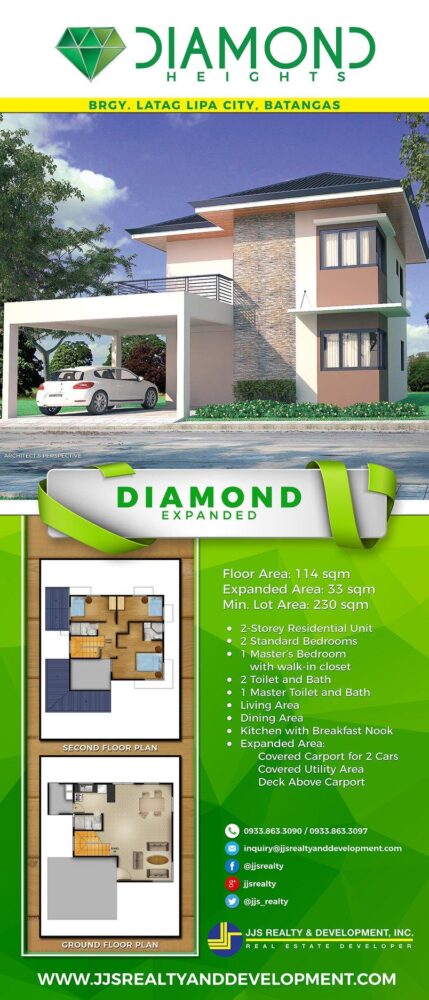

With the help of the internet, you can check out the details of properties you are eyeing. Websites of developers can be a good idea to have a check on what they have to offer. Developers package their properties and with the help of their websites, you can easily assess what would be the design of the house you would want to buy.

This is an example of a website that completely describes model units, house specifications, actual pictures, and even virtual tours. Click HERE.

2. On Site Visit

Take a tour around the property for FREE with your property consultant or sales agent. Check all nearby amenities like malls, churches, markets, and modes of transportation.

It can be helpful if you have a checklist of what you want to look for in a property. It can be critical to know what to look for and what you must avoid in a property or a house. You may miss out on something if it’s not written or printed. To help you check the property, Here is a downloadable Due Diligence Checklist.

Remember to bring the checklist with you when you are doing a site visit.

3. Make Reservation

So you made a background check and actual visit on the property you want. Make a reservation for your desired Home Unit. To make a reservation, fill up the Reservation Form and pay the reservation fee to secure your chosen property. Reservation can be paid in a bank account provided with a picture of the deposit slip.

The purpose of the reservation is to formally declare your interest in the property. The reserved property will no longer be available in the inventory for the purchase of other people. The reserved property will be exclusive for you to process.

The reservation normally has a validity of 1 month(30 days). This will help you prepare the necessary documents for your purchase and the office to prepare your requirements to be validated.

The reservation fee of the property will be deducted from the Total Contract Price of the property. However, if you decided not to proceed with the purchase, reservation fees are normally not refundable. Reservation fees vary depending on the developer, for example at Diamond Heights a subdivision at Lipa City Batangas, the reservation fee is P20,000.

4. Submit Requirements for Purchase

Make sure everything is authentic to avoid future problems. Submit requirements within 30 days after reservation. Sign all necessary documents (Contract to Sell, Deed of Restrictions, Etc.) pertaining to the sale of your chosen unit.

Your sales agent will prepae the forms and documents to sign for you.

Remember to ask if other expenses will be required, such as fire extinguishers, smoke detectors, electric utility installation, or water utility installation.

Bank and Pag-Ibig have similar requirements. If you are planning to apply for a loan at a bank or Pag-Ibig housing, you can visit this Article

5. Prepare Downpayment

Pay Downpayment(DP). Downpayment is 20% of the Total Contract Price. It is payable in 12 to 24 months at 0% interest. Monthly DP starts 30 days from the reservation date depending on the cut-off date.

The remaining 80% will be the loan. The loan can be from a bank or Pagi-Ibig housing payable up to 25years and up to 30years in Pag-Ibig. The application will be processed while you are doing your Down Payment for your new home.

6. Property Inspection

Upon completion of the property and your loan has been released, make the final assessment by inspecting your own home unit. Check all the surroundings and make sure that all is working well.

In real estate terms, your findings are called “for punch list”. In developers like JJS Realty and Development, they have a checklist of what to look for in sequence so your inspection is organized and assured that there will no missed out on the inspection of your property.

The findings will be addressed and then there will be a final inspection. If you are satisfied with the work done, it is ready for turn-over.

7. Move In

You are now ready to move in! Go through the inspection and acceptance period of your new house. Apply for Batelec and Water meter. Move into your brand new house upon acceptance.

Congratulation, New Home Owner!

This guide should fill the gaps in your home-buying knowledge and clear the path to own your new home. Remember, The more you educate yourself about the process beforehand, the less stressful it will be and the more likely you will be to get the house that you always wanted.

When it’s all done, you’ll have the confidence that comes from successfully negotiating a major step in your life.

Diamond Heights Subdivision Lipa!

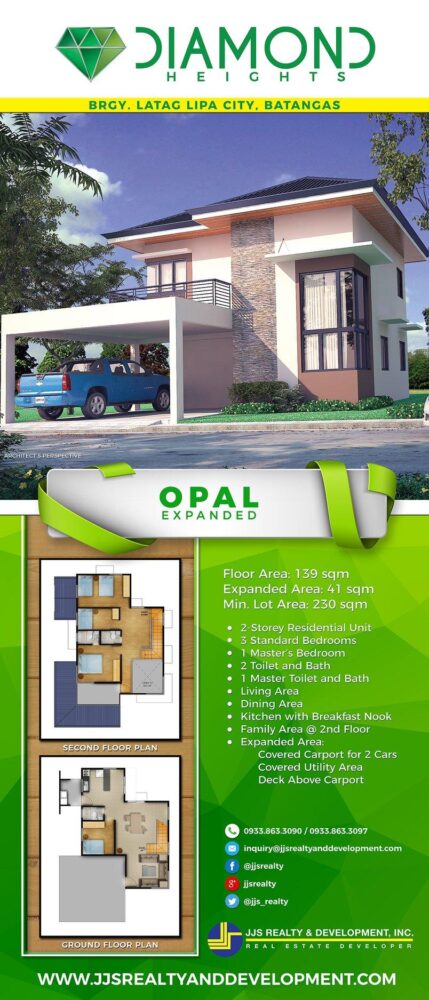

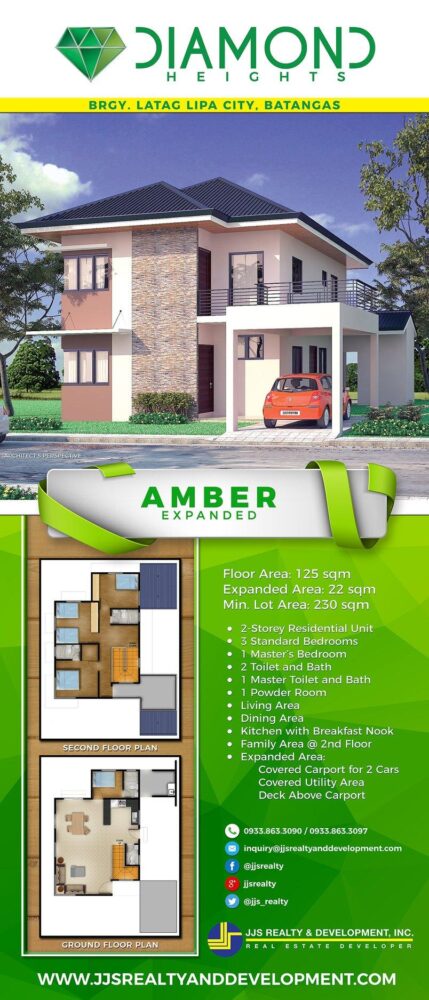

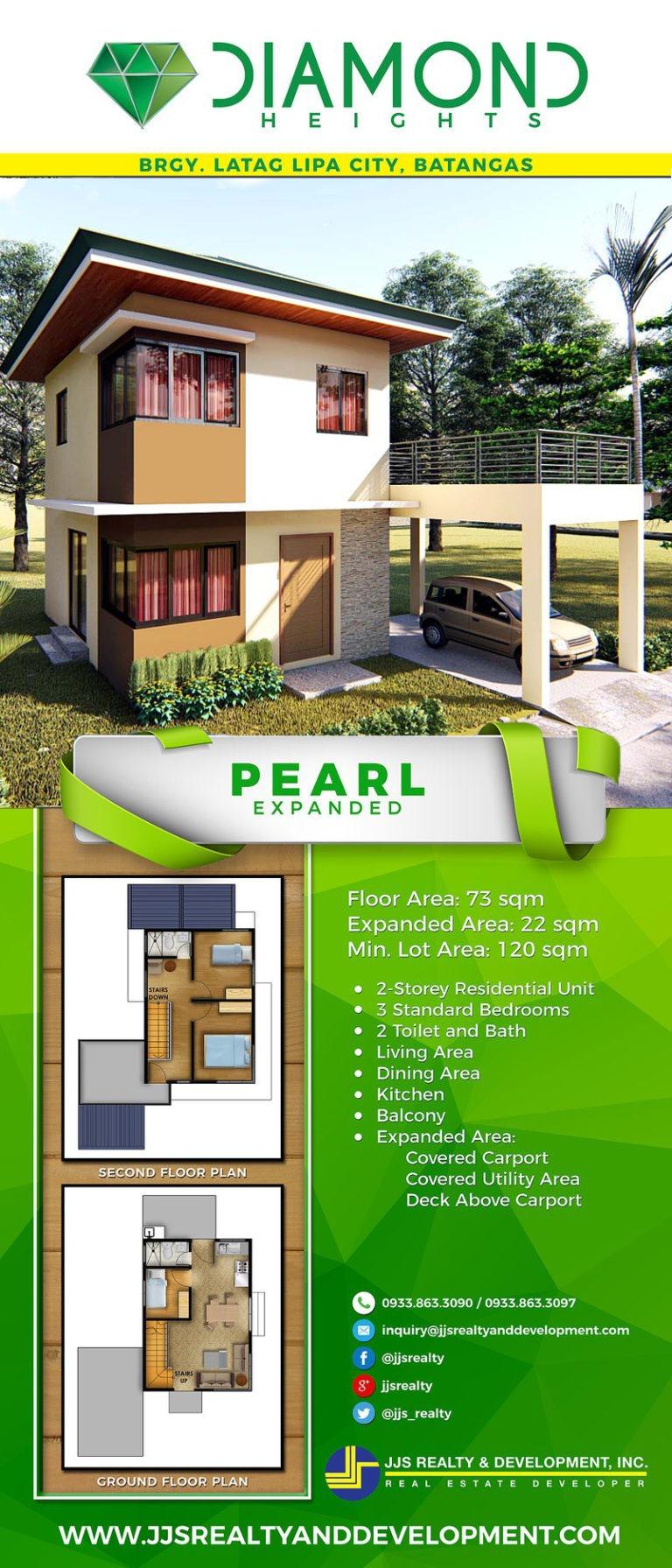

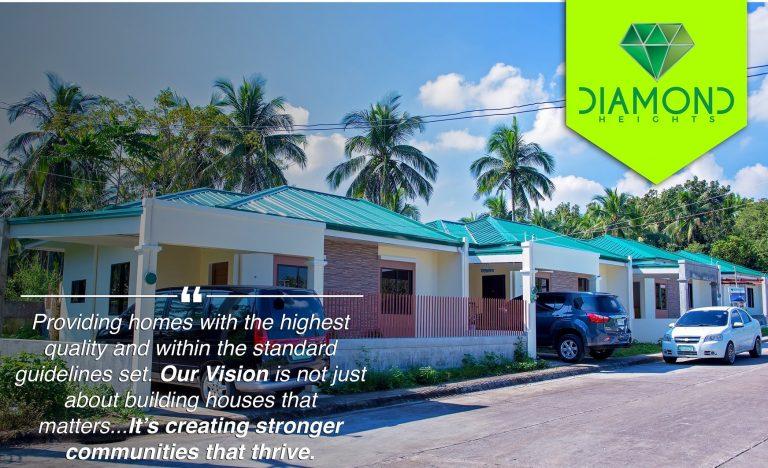

Diamond Heights Lipa is the flagship project of JJS Realty and Development Inc. located at Barangay Latag Lipa City. “Family and community are at the center of everything we do, we impart that sense of family and community to our homes.”

Diamond Heights feature Modern-Contemporary houses. Other than this, Diamond Heights is known for its vow to live closer to nature, to breathe fresh air and be away from urban areas to leap into Mother Nature’s open arms. Living in a quiet community enjoying Lipa’s cool climate is a perfect place to raise a family!

Find out more about Diamond Heights.