Some OFWs are struggling through the process of purchasing their dream house and lot. This is often because investing in real estate as an OFW isn’t as straightforward as one might wish. There are several requirements to meet, things to consider, and legal matters to go through. And with you working hard overseas, it’s difficult to figure out all of these essentials when you’re not present to handle them yourself.

You’ll find the process a lot easier if you know all the important steps to take, the considerations you have to make, and the possibilities you can get out of owning a house and lot property. Here is a comprehensive guide for OFWs.

OFW Guide: Everything you need to know when buying any real estate property or House and Lot in the Philippines.

1. Do Extensive Research

You need to be sure that the property itself is worth your investment. Here are a few points to consider when researching houses and lots:

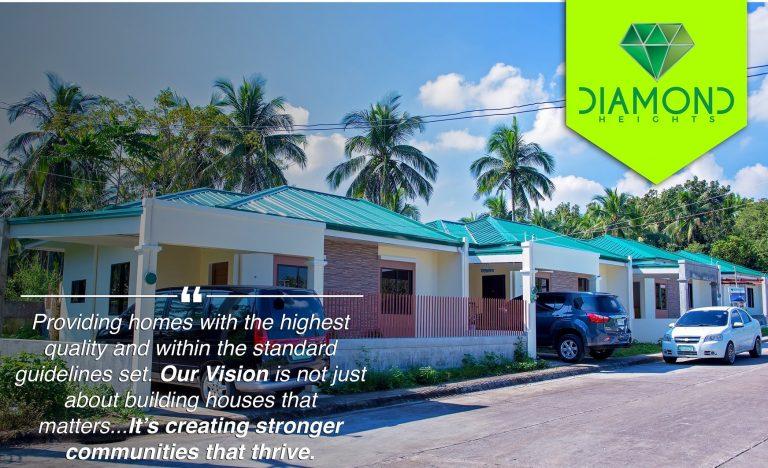

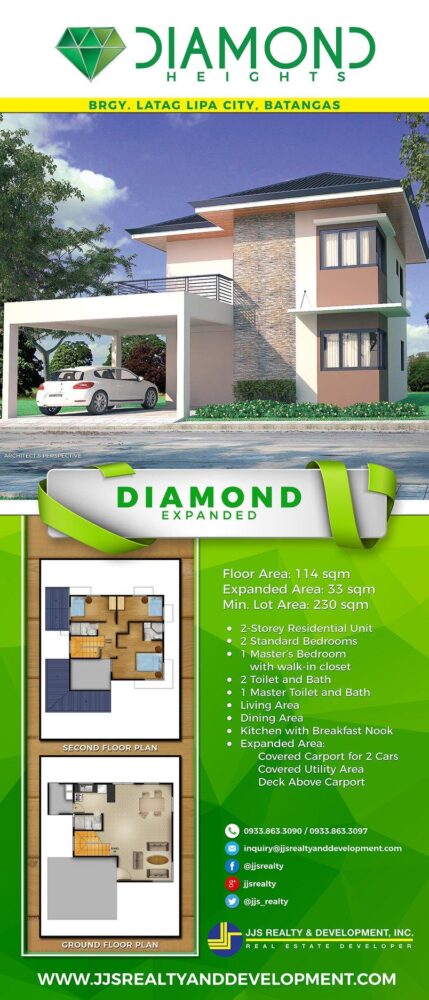

- Surroundings Houses. Look for the quality of nearby houses. If your house will be built with the same contractor as the one who builds the nearby houses it will most likely be similar in structures and material supplies. At Diamond Heights Lipa the contractor is JJS Realty & Development also the developer of the subdivision. It means they do not use third-party contractors and assurance that all houses are built with quality. Having you away from the Philippines, you can ask a family member or someone you trust to inspect on your behalf, take a tour in the place take actual pictures or video for your reference.

- Amenities. Subdivisions in the Philippines have basic amenities. Visit the website or Facebook page of developers of these subdivisions and look for their amenities. Basic amenities are Clubhouse, Basketball Court, Playground, Water Tank, Swimming Pools.

- Nearby Services. How close is the property to the nearest schools, groceries, or church? Even as an OFW, you still need to keep this in mind for when you return.

- Places to avoid. Having a house near poultry may not be a smooth decision. You should know what you don’t want to be near your home like Informal Settlers, Piggeries, Slaughter House, Cemetery, Funeral Parlot, Garbage Dump. Here is a checklist of things to look for and things to avoid in a property.

Be sure to get your information from various sources. Aside from the developer and broker, find out what homeowners and buyers in the area have to say about the development. You can find sources from Facebook or Websites and Blogs. This can help you determine your desired house and lot.

2. Figure Out Your Financing Plans

Once you’ve pinpointed the house and lot you want, be sure you can afford the reservation fee, down payment, and monthly amortization. Give yourself an honest assessment.

The process of Payments depends upon the arrangements you have agreed with the developer of the subdivision. Most of the time developers have this process of payments:

- Reservation Fee – This depends on the set standard of the subdivision at Diamond Heights Lipa it is 20,000 pesos with one month effectivity before paying your first down payment. This will give the buyer to prepare all needed requirements. The unit or the house reserved will not be available for other people that will next inquire about that unit. Reservation fees must be deducted from the Total Contract Price of the house.

- Down Payment – When it comes to Down Payment, Subdivisions require a minimum of 20% of the Contract Price, and the payment schedule can be stretched up to 30months. But it is not limited if you want to pay in a much shorter period. It is always a good idea to request a sample computation from your agent so you can always see all your options.

- Amortization – This is the remaining 80% of the balance. This can be your loan either through PAG-IBIG or Bank. The good thing about this is that loan programs are already available for Filipinos who would apply. The loan will be paid to the developer and you will pay the loan to the Bank or Pag-Ibig in a number of years you prefer. Normally Banks can give you a loan up to 25 years to pay and Pag-Ibig can give you up to 30 years to pay. With the help of this, the developer will be fully paid and you can now move into your house while paying the amortization.

It also helps to compare available financing institutions, like in-house financing, home PAG-IBIG, and bank financing.

3. Know What to Do in Case You Can’t Pay on Time

While it’s best to pay amortizations on time as much as possible, there may be cases when you simply won’t be able to. This can happen after a job loss or a family emergency that digs into your savings. Unfortunately, this incurs additional penalties which can prove to be a burden if you haven’t addressed them in advance.

Be sure to clarify payments’ “grace periods” early on. Then, should you find yourself short on finances, ask if it is possible to restructure payments to avoid penalties or foreclosure.

Purchasing House and Lot Properties: A Step-by-Step Guide

Acquiring real estate property in the Philippines while you are away has a little difference in the process and requirements. Knowing this process can save you a lot of time.

1 . SPA – Special Power of Attorney Ideally, OFWs ought to return home to personally take care of purchasing their new house and lot in the Philippines. But in case you’re unable to do so, you’ll need to appoint a legal representative or an attorney in fact. Your property agent will provide you with a Special Power of Attorney or SPA document, which you will have to sign and have consumerized in order to grant your representative the power to sign legal documents for you. Because of the trust required for this proxy role, many OFWs appoint their spouse, child, sibling, or any other close family member as their attorney-in-fact, so. They can even help you fill in the information and contacts for you.

2. Requirements – Once you found the house and lot you want to purchase, there are a few documents you need to fill out. If you are not in the Philippines, this is where your representative with SPA fills up the papers for you together with your valid 2 valid ID. Your SPA must be signed by you the owner. In case you can’t sign your SPA personally, The property agent will then send you the Special Power of Attorney (SPA) for you to sign and consularize. This is the legal document authorizing your attorney-in-fact to act on your behalf. Consularize/consularization- is a required process that authenticates the documents by the Philippine consulate. It usually costs 25 USD per document and varies from which country you’re working from. The documents will have a seal and a red ribbon over them. It’s non-refundable.

3. Have English Translations of Your Documents of Proof Signed by Your Employer or HR – You’ll need to provide copies of your documents of proof (e.g. employment contracts) in the process of purchasing your house and lot. However, in most cases of OFWs, these documents might not be printed in English if it isn’t the official language of your host country. This leaves you to rely on translated versions of these papers. In this case, you can simply ask your employer or HR to certify your papers and their translations as true and correct.

4. Loan – Your attorney-in-fact (SPA/proxy) can apply for a housing loan through the bank or through PAG-IBIG. If your payment is all set and you don’t need a loan, you can send your payment through remittance. This can also depend on the payment schedule set. Some property deals require no interest for the first few years. Always ask for the payment methods available for your loan in that way, you can choose a safe and convenient method. With the help of technology, it is also possible for you to pay them directly.

Reminders:

When you’re buying a house and lot property in the Philippines, remember that you must always stay involved in the process. As bad as it sounds, there are several scams set for OFWs like you, so be mindful of the people you deal with. It is best that your conversations are kept mainly through email or messenger rather than through the phone. And no, it is not mainly because of the cost of overseas calls. You can give us a message at Diamond Heights Lipa to verify the information you have about our subdivision.

Tips for OFWs owning House and Lot Property

Aside from having a place to come back to when you fly back home, there are many other perks to owning your very own house and lot. You can have loved ones stay at the property you’ve bought for them to have a better and much more calming environment. But if they don’t necessarily need a place to stay, then renting it out to tenants while you’re away can generate extra income for you or for your family. Here are some things OFWs have to consider before leaving your properties behind.

With all your hard work and determination to get through the struggles as an OFW, you deserve to reap the fruits of your labor. Owning a piece of home that you can call your own can make all the difference to you and to the people you’ve left behind. And while it may be a powerful investment, having a house and lot property is reassurance that you always have somewhere to belong in our own country the Philippines.

You may Inquire Now for more information about what we can have for you at Diamond Heights Lipa.