What is the retirement age in the Philippines? This is the question frequently asked by Filipinos nearing retirement age.

There has been a miss understanding of what is the retirement age. Some say it’s 60, some say it’s 65, some say it’s 56.

Why 65 years of age?

First, let’s talk about why it is set in most countries at 65 years of age and has become a culture in most countries.

The first proposed massive retirement plan is attributed to Chancellor Otto von Bismarck of Germany, who in 1881 proposed that workers receive a government-funded pension at age 70, a proposal enacted eight years later. That age was later changed during World War I to 65, a generous concession to workers yet still beyond the life expectancy of the time. The life expectancy at that time was 48.55 years old for men and 51.47 years old for women.

Retirement Age in the Philippines

The pension age is two-fold: if one worked for the private sector, the pension age is 60 years old while the pension age for one who worked for the government is 65 years old

Filipino workers pay for their social security in old age through their contributions to State-controlled insurance systems: the Social Security System (SSS), for those in the private work organizations or the self-employed; the Government Service Insurance System (GSIS) for civil servants.

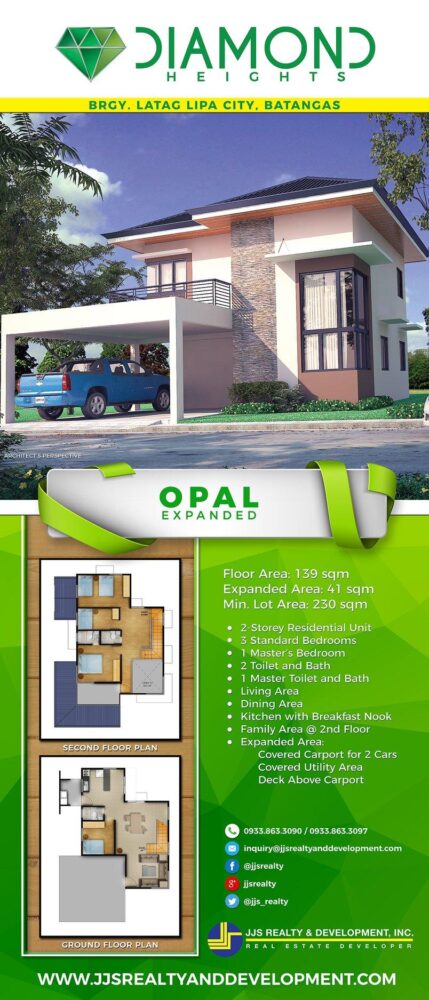

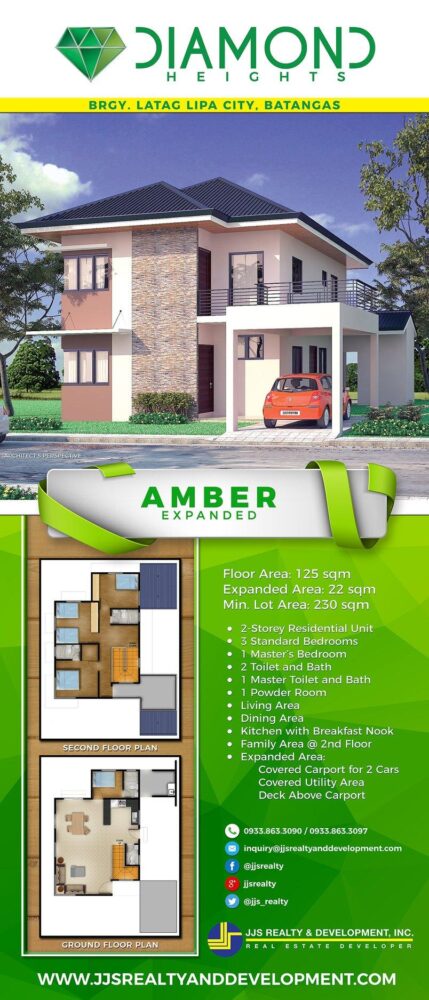

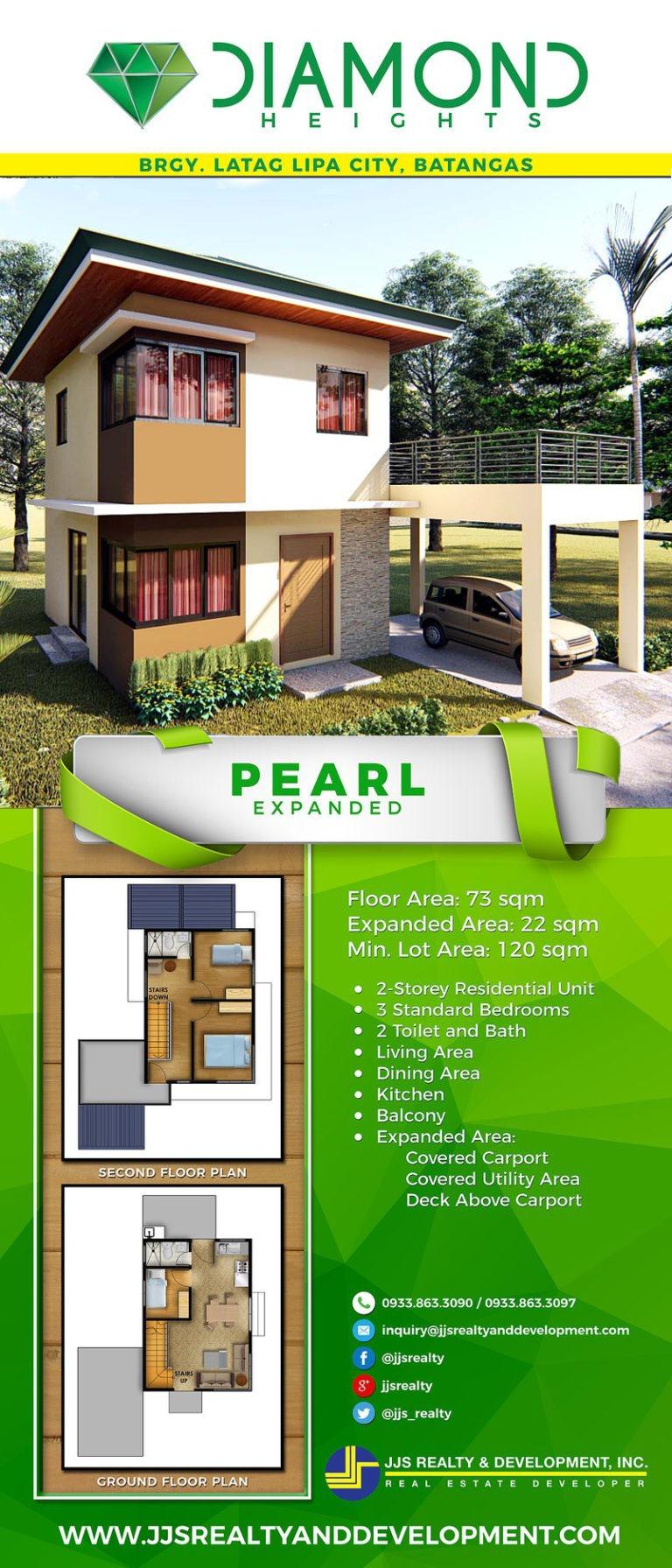

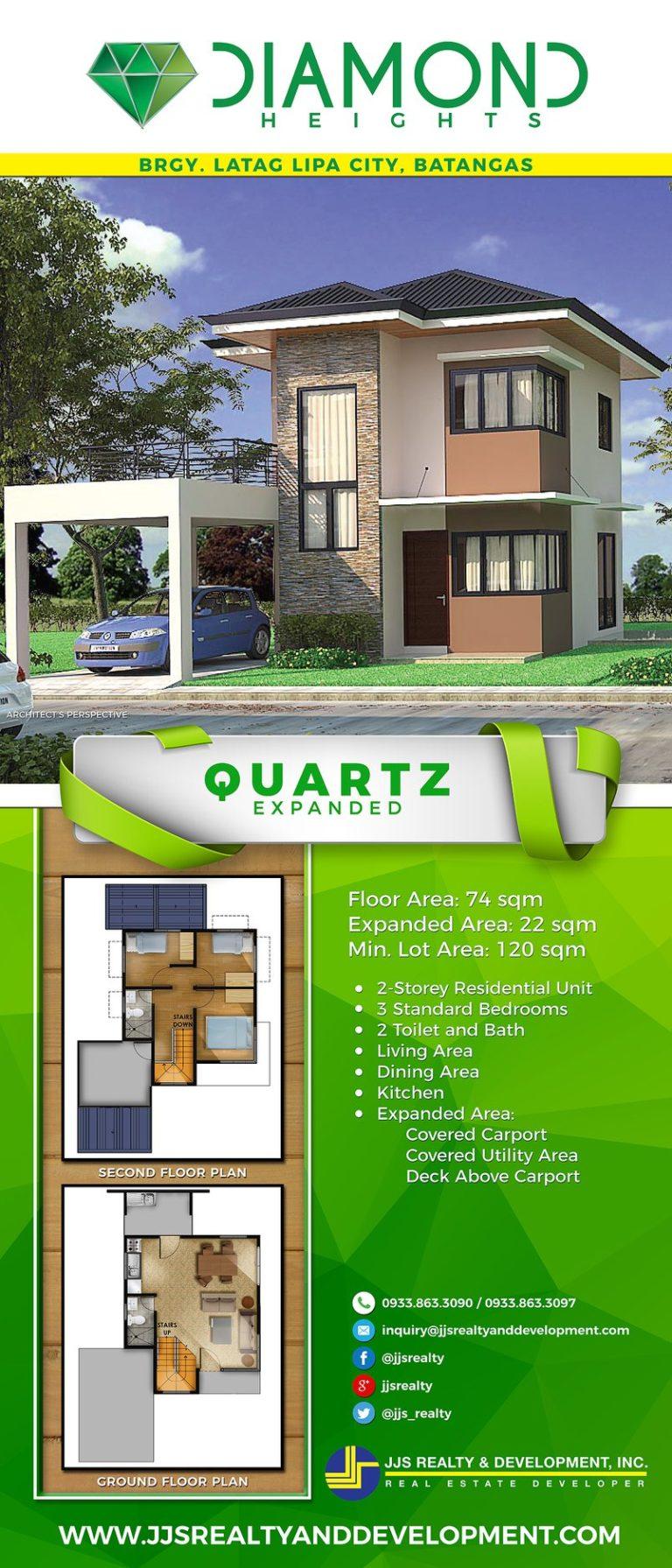

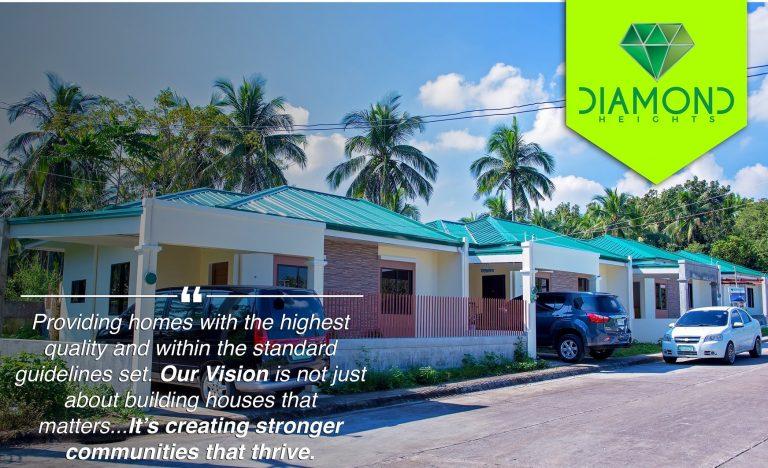

There is a growing population of retiring Filipinos. The exciting part of this is to retire and enjoy their hard-earned benefits. Buying a new home in the province with less traffic, a cleaner environment, and better overall well-being is becoming more popular. Diamond Heights Lipa is a great choice for a retiree for its natural ambiance and colder climate in Lipa City Batangas.

Check out Diamond Heights’s great amenities and strategic location. Living closer to nature near the heart of the City of Lipa.

Some leaders in the Philippines propose that the retirement age be reduced. Many bills have been proposed to lower the retirement age.

What bills have been proposed to lower the retirement age?

The bills proposing to lower the retirement age of government employees are as follows:

- House Bill No. (HBN) 8683 – An Act Lowering the Optional Retirement Age of All Government Workers from Sixty (60) Years Old to Fifty-Six (56) Years Old;

- Senate Bill No. (SBN) 1872 – An Act Lowering the Optional Retirement Age of Public School Teachers from Sixty (60) Years Old to Fifty-Five (55) Years Old;

- SBN 1222 – An Act Lowering the Optional Retirement Age of Public School Teachers from Sixty (60) Years Old to Fifty-Five (55) Years Old;

- SBN 1287 – An Act Lowering the Compulsory and Optional Retirement Age of Public School Teachers;

- SBN 1289 – An Act Lowering the Compulsory and Optional Retirement Age of Government Employees

What are the policy and trends on retirement age?

Life expectancy is expected to rise to 72.7 years in the years 2045-2050 (from 67.5 years in 2005-2010), while the number of people aged 60 and above will increase in the year 2030. In the Philippines, based on 2015 data, the population of those in this age range will balloon by 3% in 2030. Source: GSIS Studies.

In Australia, the retirement age was slightly raised to 67 in 2017 and maybe implemented until 2023. The same increase is observed in a number of Asian countries due to their aging population, which contradicts the proposed bills in the Philippines.

The policymakers of the Association of Southeast Asian Nations (ASEAN) have also been taking the necessary steps already to address the possible decrease in the workforce in the coming years.

In Malaysia, the retirement age was raised to 60 in 2012 from 55, with plans to further increase it to 65.

Thailand also did the same — to age 60 from 55.

Vietnam is also considering increasing the retirement age of males to 62 from 60, and that of females to 60 from 55.

Life expectancy is indeed are going higher and there more options where we can have a secured retirement. There are sources to build your retirement fund in the Philippines.

3 Main Sources to Build Retirement Fund in the Philippines

1. SSS (Pension Plan)

If you’re an employee of a private company, ask your manager or HR about your retirement benefit. Being aware of your employer’s policy will help you determine the amount of your SSS pension, especially if you plan to stay for the long run.

2. Investment Funds

If you’re playing the long game, stocks, bonds, and mutual funds can be great investments. Compared to traditional bank accounts, these financial instruments can potentially yield higher returns over the years. However, there’s no denying that investment funds and the like can be difficult for beginners to comprehend.

3. Real Estate

Whether it’s a small building in the city or a rest house in the province, real estate is a very lucrative investment.

If you don’t plan on using your property personally, renting it out will grant you a passive source of income in your retirement years. Also, real estate properties will only appreciate through time.

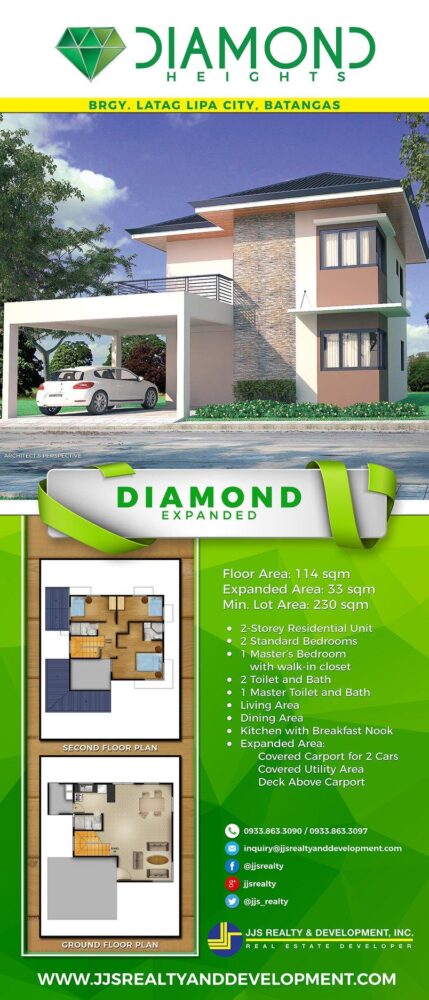

Contact Diamond Heights Lipa for a sound real estate investment in the City of Lipa in the province of Batangas and retire secured and fulfilled.